Market data industrial & logistics space Berlin

Berlin’s industrial and logistics real estate market makes a strong comeback in the first half of 2025

After a subdued period last year, both occupiers and investors are showing renewed activity, signalling a sustainable market recovery. With a take-up of around 215,000 m², the first half of 2025 delivered an exceptionally strong performance. Compared to the same period last year (116,000 m²), this represents almost a doubling (+85 %). The result returns to the mid-term average range, indicating a normalisation of demand at a high level.

215.000 m²

Area turnover

120.400 m²

New construction/completion

7,50 EUR/m²

Average rent

8,30 EUR/m²

Top rent

Take-up distribution shows a fundamental shift

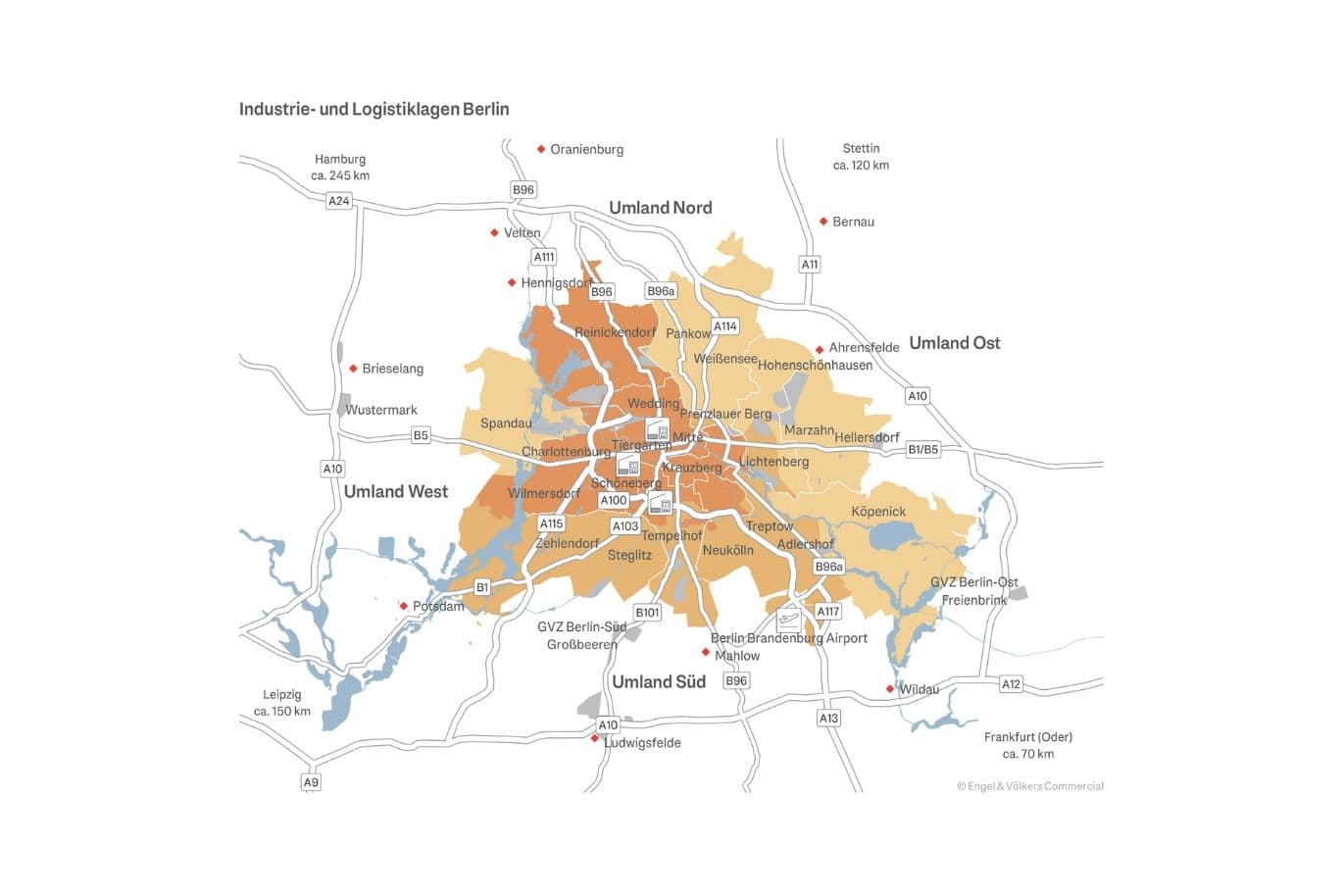

While demand within the city limits declined significantly, the focus moved heavily to the surrounding areas, which accounted for 86 % of total take-up. Key submarkets were the East (33 %), followed by the South and West (19 % each), and the North (15 %).

Market activity was driven largely by high-volume single deals, including an owner-occupier project of 60,000 m². Within the city itself, only 14 % of take-up was recorded. The main occupiers were retail (64 %), followed by manufacturing (23 %) and the transport/logistics sector (10 %).

The share of newly completed space increased significantly: 120,400 m² of new construction was immediately absorbed, representing 56 % of total take-up, compared to just 24,000 m² in the same period last year.

Rental prices in EUR/m² depending on the type of use*

| Berlin - prime location | Berlin - secondary location | Berlin - tertiary location | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Transport, Logistik | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5,50-10,00 | 5,00-8,00 | 4,50-6,50 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Produktion, Gewerbe | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

6,00-12,00 | 6,00-9,00 | 5,00-8,00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Surrounding area - North | Surrounding area - East | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Transport, logistics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4,00-7,00 | 4,00-8,00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Production, commercial | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4,50-7,50 | 4,50-8,50 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Surrounding area - South | Surrounding area - West | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Transport, logistics | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4,50-8,50 | 4,00-8,00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Production, commercial | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4,50-9,00 | 4,50-8,50 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*The figures refer to average existing properties with a floor area of up to 3,000 m². Higher rents may be achieved for new constructions, premium-fitted properties, or locations in especially strong micro-markets.

This underscores the continued strong demand for modern, efficient logistics properties. Rents also increased: the average rent rose to €7.50/m², with prime rents climbing slightly to €8.30/m². The market dynamics in the first half of the year indicate a positive trend for the remainder of 2025. Demand for high-quality space is expected to drive further rent growth. For the full year, take-up of 360,000–380,000 m² is considered realistic—provided that activity in large deals and new developments continues.

You may also be interested in

Industrial & logistics properties in Berlin

Industrial & logistics properties in Berlin How to bequeath real estate in a tax-efficient and conflict-free way

How to bequeath real estate in a tax-efficient and conflict-free way- 3 min.

- 7. May 2025

&w=1920&q=75) Deals & Insights on the Berlin real estate market for residential and commercial properties

Deals & Insights on the Berlin real estate market for residential and commercial properties Environmental protection areas, rent control & conversion ordinance in Berlin

Environmental protection areas, rent control & conversion ordinance in Berlin Berlin market for residential and commercial buildings grows

Berlin market for residential and commercial buildings grows- 4 min.

- 17. July 2025

“Quasi-division ban”: how the permit requirement affects property subdivisions

“Quasi-division ban”: how the permit requirement affects property subdivisions